Some Questions

- What Early-Stage Companies Need to be Attractive to Investors? The Oasis500 Experience in the first 4 years.

- How do I attract seed capita?

- What about Angel investment?

- How do I get a Series A investment from a institutional VC?

We use the results observed from our experience with funding and accelerating seed and early-stage companied at Oasis500 and share some of the returns reported so far.

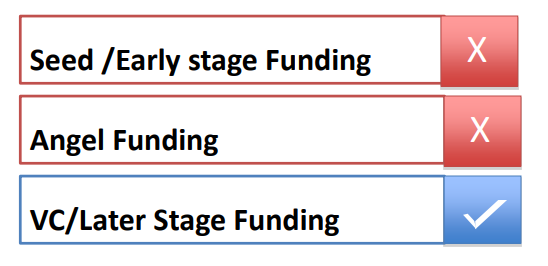

Current Funding Gaps in the MENA Region

No options for funding for Pre-revenue start-ups or seed/early stage funding

• The initial personal/family funds raised by entrepreneurs

Many options for growth capital for Post-revenue later stage funding

• Venture capital firms, Private equity funds, banks

Is it just about funding?

• Created a private company to invest in and accelerate technology startups

•We raised our first $7M fund (4 years); today it is growing to $10M and eventually $50M

•However, what happens if you give funds to people who do not know what to do with it?

It is Not Just About Funding

• Oasis500 not only provides seed capital for companies, it adds unique value by offering entrepreneurs:

– Intensive training (boot camp)

– 100-day acceleration plan with continuous guidance and follow-up

– Valuable mentorship and guidance from industry leaders

– Help in raising follow-on capital

• Such mentorship has been proven to increase the likelihood of startup success

What We Do?

Oasis500 operates 4 major activities to address the missing gaps in the ecosystem:

Overview: Results

The First $5.3M of invested funds (through June 2015) … Resulted in…

– Over $30M raised by our startups.

– Delivered over 40 Business Development Training Bootcamps: training over 2,000 entrepreneurs 8,000 applicants Submitted a business idea.

– As of Nov 2015. Oasis500 Invested in 109 companies generating $109M in Value

Seed Funding & Acceleration

Invested in the top entrepreneurs from 40+ Waves, Over 100 companies (Target for years 1 and 2, 32 companies) Initial investment USD $30K in cash and services

Grow track

Introduction of New Investment Track for established Businesses/Grow Track :

• Introduced in January 2013

• Strategic partnership with

– Wamda

– Mena Venture Investments

– Mena Apps

– Accelerator Technology Holdings

• Program Status update

– Applications Received: 300

– Companies invested in: 11

– Total amount invested to date: USD $1M

What We Do?

Angel Network

• First 15 Angel Network Events (Amman, Dubai, Qatar, Beirut, Bahrain)

• 5-9 companies present at an event

• 80-120 investors attend per event from all over the region

• 45 companies presented in total, 28 of which were Oasis500 startups

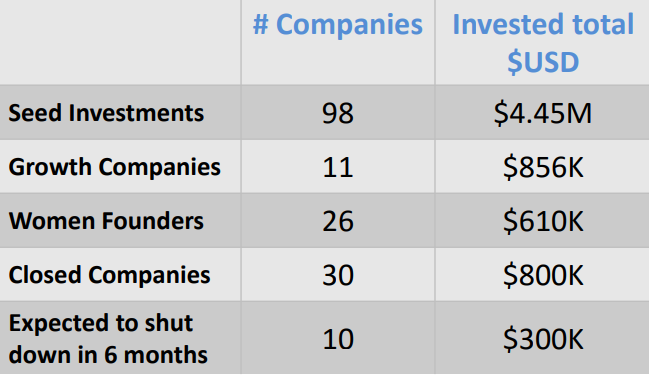

Performance Summary

USD $5.3M in 109 Companies

69 Active Companies with a ROI of 2.15x

Some facts

• Overall ROI for Oasis500 investments so far, with write-offs for expected shut downs: 1.7x

• What is the ROI for similar accelerators in the U.S.? – 1.3x

• Comparison of Seed stage versus Grow – who gives a higher ROI?

Seed companies: 2.3x

Grow companies: 1.31X

Bootcamps: Beirut, Palestine, Tunis, Muscat, Dubai, Riyadh, Morocco, others

Ramallah Bootcamp

We also created a special program for Gaza with Gaza sky geeks

Ramallah & Gaza Bootcamps Za’atari boot camp April 2016.

Some Surprises

•Demand much higher than expected:

–entrepreneurs, investors, mentors

•Women success rate 2x that of men

–20% of bootcamp trainees 40% of funded companies led by women

• Entrepreneurship training had to be deeply localized

–Standard courses did not work without lots of customization

–“Imported” material was not effective

•Very hard work is needed – this is not a natural act

Some Lessons

• Training is a loss-generating activity – cannot be born by Investors or Entrepreneurs

–Got sponsors: UK, U.S., World Bank, UNICEF, local companies

• Preparation before going to investors is a must:

–Our companies practice over many, many cycles before we let them present to the Angel Investment Network

–Demonstrating speed of execution is a must

–Team formation – adding founders is a must

• Ideas are still conservative, but slowly getting to be more innovative and localized

• Societal impact took place much faster than expected

Issues to Consider

•With practice we have seen U.S.-quality pitches

•U.S./EU investor interest, including 500 Startups and other funds

•Driving Tech Innovation into Society

•A way for local investors to ride the next wave of innovation: instead of importing it

•Returns, inclusive of Arab Spring, are better than any other class of investment in MENA

Summary

•Demand by entrepreneurs much higher than we imagined

•Investor appetite stronger than we thought

•Mentors engaged much more aggressively than we hoped

• Final lesson: A large under-served market with a huge demand for on-line/mobile content and ecommerce

Oasis500: A true early-stage fund and accelerator that will positively change tech entrepreneurship future of MENA

Author: Usama Fayyad