InvenSense Announces Second Quarter Fiscal Year 2015 Results

Company Generates Record Revenue of $90.2 Million

SAN JOSE, California, October 28, 2014 InvenSense, Inc. (NYSE:INVN), the leading provider of intelligent sensor solutions, today announced results for the second quarter of fiscal year 2015, ended Sept. 28, 2014.

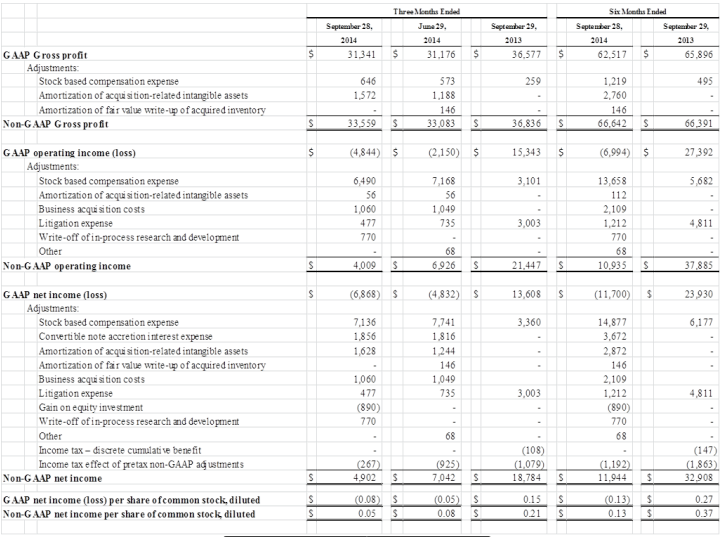

Net revenue for the second quarter fiscal 2015 was $90.2 million, up 35 percent from $66.7 million for the first quarter fiscal 2015.

Gross margin determined in accordance with U.S. generally accepted accounting principles (GAAP) for the second quarter of fiscal 2015 was 35 percent, compared with 47 percent for the first quarter of fiscal 2015. GAAP gross margin for second quarter fiscal 2015 included stockbased compensation and related payroll taxes, and amortization of acquisition intangibles.

Excluding these items, nonGAAP gross margin for the second quarter fiscal 2015 was 37 percent, compared with 50 percent for the first quarter of fiscal 2015. The sequential decrease in gross margin was primarily attributable to two factors: a nonrecurring inventory charge largely related to earlier generations of the company’s products that reduced the gross margin by approximately eight percentage points, and a shift in revenue mix towards lower margin, high volume customers that reduced the gross margin by approximately five percentage points.

GAAP net loss for the second quarter of fiscal 2015 was $6.9 million, or 8 cents per share. By comparison, GAAP net loss was $4.8 million, or 5 cents per share for the first quarter fiscal 2015.

GAAP net loss for second quarter fiscal 2015 included stockbased compensation and related payroll taxes, accretion interest expense on convertible notes, amortization of acquisition intangibles, a writeoff of inprocess research and development costs in connection with the company’s acquisition of the microphone business line of Analog Devices, Inc. in fiscal 2014, business acquisition costs, litigation expenses, which were partially offset by a gain on the company’s equity investment in Trusted Positioning, Inc., and income tax effect of nonGAAP adjustments.

Excluding the items described above, nonGAAP net income for the second quarter of fiscal 2015 was $4.9 million or 5 cents per diluted share, compared with $7.0 million or 8 cents per diluted share for the first quarter of fiscal 2015.

The reconciliation between GAAP and nonGAAP financial results for all referenced periods is provided in a table immediately following the Unaudited GAAP Condensed Consolidated Statements of Operations below.

Management Qualitative Comments

“This is an exciting time for our company,” said Behrooz Abdi, president and CEO. “Q2 was a record revenue quarter, with the North America region leading our growth. During the quarter, we successfully ramped several key design wins, leveraging our strategic inventory of second- generation 6axis products in order to meet demand for both our second and third generation devices. With strong market share gain in mobile, our team has executed on the first step in our growth strategy, while our investment in content increase has delivered a full portfolio of differentiated products that we believe will provide meaningful growth opportunity for years to come. As we move beyond the second quarter’s inventory adjustment, we believe that our solid business model will allow us to drive improved earnings leverage and shareholder return in the coming quarters.”

Second Quarter Fiscal Year 2015 Earnings Conference Call

A conference call will be held today at 1:30 p.m. Pacific Time to discuss the quarter’s results and management’s current business outlook. To listen to the conference call, please dial (800) 688 0836 ten minutes prior to the start of the call, using the passcode 63496403. International callers, please dial (617) 6144072. A taped replay will be made available approximately two hours after the conclusion of the call and will remain available for two days. To access the replay, please dial (888) 2868010 and enter passcode 41375040. International callers please dial (617) 8016888. The conference call will be available via a live webcast on the investor relations section of InvenSense`s web site at www.invensense.com/ir. An archived webcast replay will be available on the web site for two months.

Note Regarding Use of NonGAAP Financial Measures

As discussed above, in addition to the company’s condensed consolidated financial statements, which are presented according to GAAP, the company provides certain nonGAAP financial information that excludes, stockbased compensation expense, litigation expense, business acquisition costs, amortization of fair value writeup of acquired inventory, amortization of acquisitionrelated intangible assets, accretion interest expense on convertible notes and other nonGAAP financial adjustments. The company uses these nonGAAP measures in its own financial and operational decisionmaking processes. Further, the company believes that these financial and operational decisionmaking processes. Further, the company believes that these nonGAAP measures offer an important analytical tool to help investors understand the company’s core operating results and trends, and to facilitate comparability with the operating results of other companies that provide similar nonGAAP measures. These nonGAAP measures have certain limitations as analytical tools and are not meant to be considered in isolation or as a substitute for GAAP financial information. For example, stockbased compensation is an important component of the company’s compensation mix, and will continue to result in significant expenses in the company’s GAAP results for the foreseeable future, but is not reflected in the nonGAAP measures. Also, other companies, including companies in InvenSense’s industry, may calculate nonGAAP financial measures differently, limiting their usefulness as comparative measures.

ForwardLooking Statements

Statements in this press release that are not historical are “forwardlooking statements” as the term is defined in the Private Securities Litigation Reform Act of 1995. Forwardlooking statements are generally written in the future tense and/or preceded by words such as “will,” “expects,” “anticipates,” or other words that imply or predict a future state. Forward looking statements include any projection of revenue, gross margin, expense, earnings, stockholder return or other financial items discussed in this press release, including the strength of our competitive positioning, the strength of design activity across all of our multiaxis products , the differentiation of our products from those of our competitors, the emergence of new opportunities for our products, increased demand for our products, growth opportunities and our ability to capitalize on them. Investors are cautioned that all forwardlooking statements in this release involve risks and uncertainty that can cause actual results to differ from those currently anticipated, due to a number of factors, including without limitation, intense competition in our industry; our achievement of design wins; our dependence on a limited number of customers for a substantial portion of our revenues; the continued adoption of motion tracking and motion sensing as an interface in consumer electronics products; decreases in average selling prices for our products; our lack of longterm supply contracts and dependence on limited sources of supply; consumer acceptance of our customers’ products that incorporate our solutions and our ability to continue to develop and introduce new and enhanced products on a timely basis; as well as changes in economic conditions in our markets and other risk factors discussed in documents filed by us with the Securities and Exchange Commission (SEC) from time to time. Copies of InvenSense’sSEC filings are posted on the company’s website and are available from the company without charge. Forward-looking statements are made as of the date of this release, and, except as required by law, the company does not undertake an obligation to update its forwardlooking statements to reflect future events or circumstances.

About InvenSense

InvenSense Inc. (NYSE:INVN) is the world’s leading provider of intelligent sensor solutions for consumer electronic devices. The company’s patented InvenSense Fabrication Platform and patentpending MotionFusion(TM) technology address the emerging needs of many massmarket consumer applications via improved performance, accuracy, and intuitive motion, gesture and soundbased interfaces. InvenSense technology can be found in consumer electronic products including smartphones, tablets, wearables, gaming devices, optical image stabilization, and remote controls for Smart TVs. The company’s MotionTracking products are also being integrated into a number of industrial applications. InvenSense is headquartered in San Jose, California and has offices in Canada, China, France, Korea, Japan, Slovakia, Taiwan, and Boston, MA. More information can be found at www.invensense.com or follow us on Twitter at @InvenSense.

©2014 InvenSense, Inc. All rights reserved. InvenSense, MotionTracking, MotionProcessing, MotionProcessor, MotionFusion, MotionApps, DMP, AAR, and the InvenSense logo are trademarks of InvenSense, Inc. Other company and product names may be trademarks of the respective companies with which they are associated.

# # #

For Investor Inquiries, Contact:

Leslie Green

Green Communications Consulting, LLC

650.312.9060

ir@invensense.com

For Press Inquiries, Contact

David A. Almoslino

Senior Director

Marketing and Communications

InvenSense, Inc.

408.501.2278

pr@invensense.com

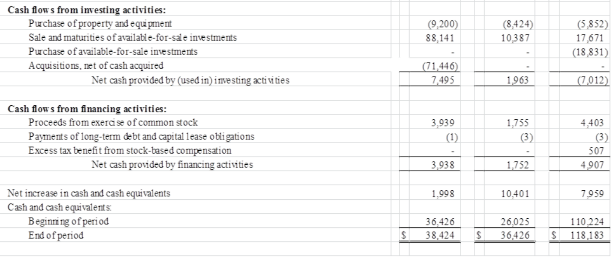

INVENSENSE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(Unaudited)

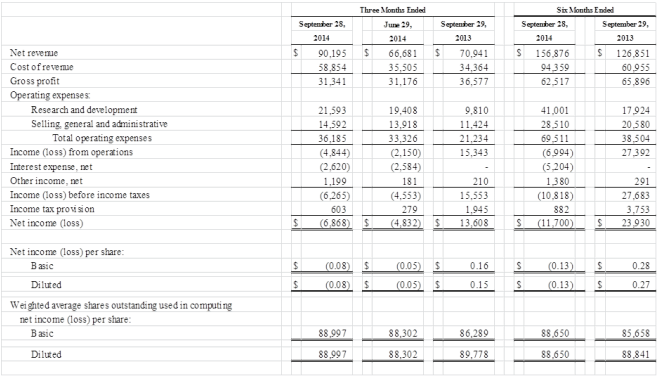

INVENSENSE, INC.

RECONCILIATION OF GAAP TO NONGAAP FINANCIAL RESULTS

(In thousands, except per share amounts)

(Unaudited)

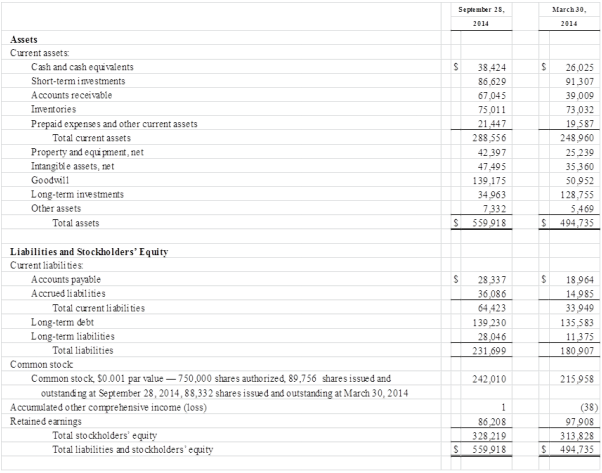

INVENSENSE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except par value)

(Unaudited)

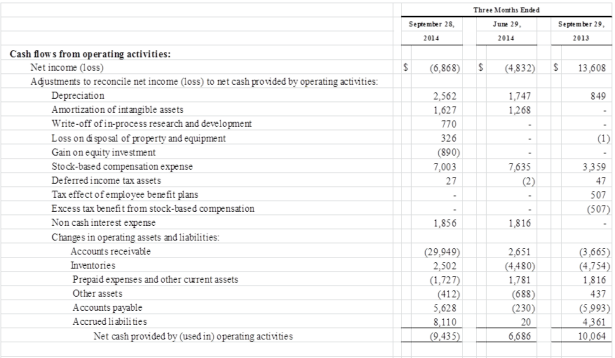

INVENSENSE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN THOUSANDS)

(Unaudited)